By: CircleUp

(Official caveat: this guide is for information purposes only — you should consult with a lawyer before making any decisions on advertising to potential investors. These are guidelines only, not specific recommendations for any company.)

For the first time in history companies can advertise their private capital offering. This guide is intended to help companies in doing so.

A little more than a year ago —September 23, 2013— the Securities and Exchange Commission (SEC) amended 80-year-old securities regulation and introduced a new exemption, Rule 506(c) of Regulation D. Companies that exercise this exemption, which we’ll call 506c for short, are permitted to generally advertise their fundraise.

Generally speaking, companies aren’t limited to how they advertise, or who they advertise to (other than being truthful, accurate, and balanced – of course). Online or offline. Email, social, billboards, flyers, word-of-mouth or TV. Friends, family, customers, supporters or industry peers.

While not a panacea, the ability to advertise unlocks new opportunities. A company like Nomad, for instance, can now reach across the web to its global community of customers and supporters, many of whom they couldn’t have reached out to for potential investment before.

In the past year more than 30 companies have raised under 506(c) on CircleUp — giving us the awesome opportunity to see how they’re doing it. This guide is a result of our observations and learnings. We’ll keep it updated — and if you have any questions or suggestions, we’d love to hear from you in the comments.

Four Channels of Outreach

We’ve observed companies targeting four primary channels. This list isn’t exhaustive, but it’s a good start.

- Social

- Website

- Press

Let’s look at a couple tactics for each, starting with everyone’s most beloved form of communication — email.

1. Email

“Email is dying!” Ah, nonsense. Email is still the most direct and relevant way to reach your extended network. Here’s a structure you can use when designing an email campaign for investor outreach.

- Curate your list

- Craft your story

- Reach out

Step 1: Curating your list

We strongly advise against blasting out generalist emails to strangers. The odds of a stranger opening and engaging with your email, let alone writing a sizeable check, are infinitesimally small. Best not to waste your time. Rather, focus on the universe of people who know you personally, or your brand. You want your outreach to be relevant—and if they fall in this population, it will be.

If you have an existing mailing list of customers / supporters you can start here. But no worries if not, there are other ways to curate your list. LinkedIn being a great example.

Linkedin is likely the richest source of data on your professional network — and, thankfully, it makes exporting said data insanely easy. If you’re unfamiliar with LinkedIn’s Export Connections Tool, give it a spin. After you export your contacts to CSV, clean the data for people you do not want to contact. Remember, you want it to be relevant. So don’t send it to anyone who may find themselves muttering, “Seriously… Who is this person?”

You may also want to consider exporting your email contacts to CSV. Every email provider — Gmail, Yahoo, Outlook, etc.—makes this easy.

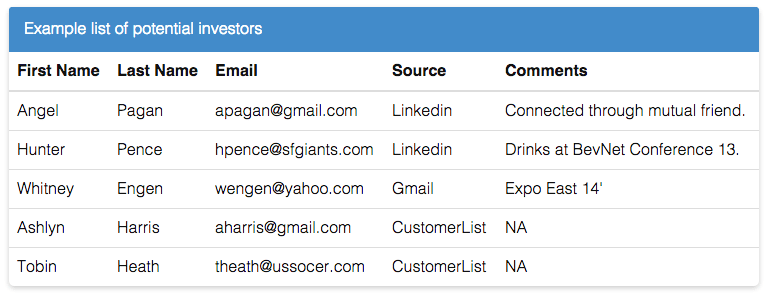

If you have multiple lists you’ll then want to aggregate and normalize each data source into a single “Investor Outreach” list. Include 4 columns: (i) First Name, (ii) Last Name, (iii) Email, and (iv) Source.

Lastly, add any additional contacts you want to reach who are not on these lists — personal friends or professional acquaintances not on LinkedIn. The final result might look something like this:

Step 2: Crafting your Story

Now for your messaging. You may only have one shot to acquire their attention so your initial communication needs to resonate. You absolutely need to be mindful of regulations: don’t over promise or make statements that are one-sided. (Of course, as with all securities issues, best to consult your attorney.) And less is more here. The email is the appetizer, intended to acquire the readers’ interest in the main course, your profile page.

A quick word on security regulations: currently, only accredited investors can invest in a 506c offering. The majority of your readers will not be accredited, and therefore not eligible to invest, but no worries here. You’ll just want to be cognizant of their time and communicate this requirement up-front.

Why email non-accredited investors at all? For one, it’s unlikely you’ll know beforehand precisely who is accredited. And more importantly: even if they are not accredited, and not eligible to invest, they may still be supporters and know someone who is. This brings us to an essential element of every email you send: the referral ask.

Always Asking for Referrals

Remember Hotmail? Blast to the past, I know. Well Hotmail built referrals into its product which in return drove its virality and exponential growth. This is the sentence Hotmail appended to every email:

“PS: I Love You. Get Your Free Email at Hotmail”

Brilliantly simple and effective. And we recommend following suit by always asking your network to share with others. (Alas, Hotmail eventually removed ‘PS: I Love You’ from its message.)

We put together a template you to adapt for your email outreach. It’s for representative purposes only—you’ll want to add your own color and make it your own.

Step 3: Reaching out

Last on the list: sending out your message. If you don’t already have an email service, we’re big fans of Mailchimp. It’s simple, beautiful and effective; and has all the features you’ll need out of the box. Mainly CSV import, which lets you import the list we created earlier and send an email to them. If you’re unfamiliar with Mailchimp, here’s what you’ll want to do:

- Create an account.

- Create a ‘List’; call it Potential Investors.

- Upload all of your contacts using CSV import. Tutorial: How to use CSV Import.

- Create a Campaign to send to your Potential Investors List. Tutorial: How to create a Mailchimp Campaign.

All in all, it should only take 25 – 30 minutes to get everything set up. Let us know in the comments if you have any questions. I wouldn’t fret formatting. I recommend using their default template — a minimalist, clean design that works on all devices—and simply adding your logo to the header. (Note: Mailchimp has standard unsubscribe links and tools to make sure you comply with anti-spam regulations. Don’t try to game the system, it’s important to stay within the lines here.)

2. Social

Email: Check. Onward to Social. Here are a few suggestions.

Twitter & Facebook

Keep your network up-to-date on your offering. New product, new funding milestone? You can link to your profile and let your network know.

You’ve already reached out to your LinkedIn contacts but you can still post updates to your personal profile. We also recommend posting to relevant Groups you’re a member of — industry trade groups, Alumni groups, et cetera.

3. Your Website

Your website is a great place to connect with potential investors. Particularly for consumer-facing companies, where many visitors will be customers who are already familiar with the value-proposition of the brand. CircleUp has a designed a collection of widgets to make advertising on your site easy. For companies currently fundraising you can find your embeddable widgets here: https://circleup.com/c/%5Byourcompany%5D/widgets.

You can design your own just as well. Here are a few examples of how companies are reaching potential investors via their websites today:

- KidVentures Uses the ‘Fund Us’ badge

- KosoFresh Uses the ‘Fund Us’ badge

- Nomad Designed a dedicated landing page for potential investors.

- Plum Added an “Invest” button on their About page.

Each has its own merit. We’ve seen great performance with the “Fund Us” badge. It’s bold and catches the eye. Let us know if you have any questions here — technical or non. We’re glad to help.

4. Press

Press is tough. But it’s worth the hustle because it can open doors to unique audiences outside your first, second and third-degree networks. Audiences you’re unlikely to reach otherwise.

We recommend focusing your initial outreach on two types of press:

- Trades Publications and / or organizations in your direct or tangential industries.

- Local City, district and state newspapers? Send a note to them. They love covering innovative companies in their region — especially companies with products their readers can relate to.

Here’s a playbook you can reference to help streamline your press outreach.

- Create a spreadsheet and list out every potential contact, across both Trade and Local press. Depending on the length, you may want to rank order them.

- Draft your PR template. You’ll want to include the essentials: (i) Company overview; (ii) Founder Bio’s; and (iii) Contact information. We’ve included an example you can use below.

- Send a personal note to everyone on your list. Make yourself available for interviews and stories.

- Always ask reporters to link to your fundraise—you want readers to be a single click away from learning more about your company.

Here’s a template you reference to save you time: Template: 506c PR Outreach

Bringing It All Together

Whew. A lot of ground covered here. To summarize:

- Curate your list // Craft your story // Reach out

- Resource: Email Outreach Template

Social

- Twitter / Facebook

- LinkedIn Groups

Website

- Use CircleUp’s funding widgets; or

- Design your own.

PR

- Local

- Trade

- Resource: PR Outreach Template

I hope this is enough kindling to get started. And hey, no need to stop here. There are endless ways to reach out to potential investors. We’d love to hear from you. Let us know in the comments below how we can help.

Happy fundraising!