This post features an essential closing checklist, downloadable and printable here, which we helped create for entrepreneurs to guide and monitor fundraising periods.

Fundraising is really hard to do, no matter how attractive the company. It is especially hard in for emerging consumer and retail brands, where there’s no centralized network surfacing the most promising entrepreneurs, like in tech with Silicon Valley. This leads to fundraises in early-stage consumer typically taking an average of 8 to 12 months to close. That is far too long to spend during the critical initial years of business.

Though raising money is hard at every stage of the process, the end is particularly challenging.

You’ve found investors who said they want to invest, but closing the round, as in actually getting the money in the bank after investors demonstrate interest, is often the hardest part. And it’s not just hard, it the most dangerous time in the fundraising cycle. A broken term sheet could be life-threatening for a younger company, because it’s immensely difficult to restart conversations with other investors who faded out. They will have likely moved on, or will be suspicious you’re re-engaging with them as a backup option, leaving you now with less cash than when you started the round.

Having lost your initial prospects, you then cast a wider net and go to investors who are less likely to fund your kind of business. These investors will know you’ve been trying to raise money for a while and will suspect a term sheet was broken. No matter what happened the circumstance of that broken term sheet, potential investors will be dubious and resistant, easily creating a downward spiral that can end a company.

So once you have interested investors, it is essential to close quickly.

Failure to close interested investors, and quickly puts at risk all the hard work you’ve put in.

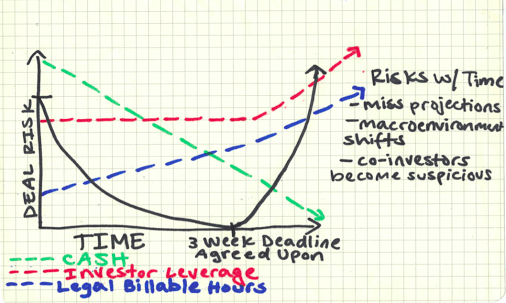

The longer you take to close, the greater the “Deal Risk”. As Deal Risk increases, so do the odds of the deal falling apart. Time is not your friend. Every day that passes is an open opportunity for new variables to come into play. Nothing is out of the realm of possibility. Maybe something occurs with the lead investor, or the partner leading the deal on his or her behalf, and the transaction becomes deprioritized. Or maybe the macro-environment deteriorates, or a systemic risk emerges or increases for your category, breeding broad distrust. Finally, co-investors can get suspicious for a number of reasons more directly related to your business, such as a missed budget or sales projection, leading them to want to re-trade on key terms.

If there is ever a time to remember the adage “time is money,” it’s during the final inning of your fundraising efforts.

That said, be wary of losing on a deal on structure. The more exotic the rights agreement, the longer it will take to negotiate. As negotiations drag out, billable hours for your attorneys grow – increasing the time you are left susceptible to external and internal risks that reduce your leverage with your lead investor. Lead investor negotiation leverage tends to be inversely related to the amount of other potential lead investors around the table and the amount of cash in the company’s bank account.

Credit: Zach Grannis, Business Operations Manager, CircleUp

Indeed, closing a round is really hard. Lots of things can go wrong, and a mistake can be fatal for your business. So how do you do it? How do you close your round the right way? We’ve closed hundreds of rounds. But we’ve also seen some blow up after investors have committed to investing. From that experience, we’ve laid out these 6 pieces of advice for closing your round:

1. Shift into overdrive. You’ve been running fast, juggling being CEO and raising money. But now, you need to find a new gear. This is not a time to go offline or take time off to preemptively celebrate. You need to over communicate with all stakeholders until money is in the bank. You’ll sleep less now, but if you can shift into high gear, you’ll be much more likely to close the round — and thus sleep better in the future.

2. Become hyper involved. Don’t think you’ve done the heavy lifting, and can now hand off the clean up work to someone else. The CEOs I’ve seen get into trouble while closing a round have almost always tried to transition the close to someone else, be it lawyers or a VP of Finance. Your investors and lawyers should still be totally engaged at this final period, but to do their jobs — not yours. The message you send to investors when you turn over the control to others is one of indifference and disrespect. Mistakes happen when others without full context take over, and investors have second thoughts when you go MIA.

3. Develop your own closing checklist. There is a critical list of actions that must be completed to close your deal. Each deal is unique, but template checklists are valuable starting points. You can add or subtract tasks after you’ve thought about your unique deal and spoken with key stakeholders. Once you have your list, post it on your desk. Review it daily. Let it become your life. To get started, here’s a great checklist we’ve helped create.

4. Deadlines, deadlines, deadlines. Set deadlines and be aggressive. Use the checklist and your lawyer to anticipate what must happen in advance of each deadline, ensuring things get done. Make sure your investors, and all key stakeholders, are aware of all deadlines that pertain to them. This is key. I’ve seen deals derailed because final documents were sent to an investor out of the blue…and the investor was halfway around the world. Who’s at fault? If it’s your deal, you are responsible. Today, documents can be signed remotely via Docusign, but it still requires the CEO to be very communicative about responsibilities for everyone involved. According to Nick Giannuzzi of the Giannuzzi Group, a leading consumer product law firm that’s worked Suja, Pirate’s Booty and Glaceau (maker of vitaminwater), “it takes about two weeks to complete standard deal documentation for the typical growth equity deal in early-stage consumer.” The legal list referred to in the checklist is from the Giannuzzi Group (reprinted with permission) and is terrific to align lawyers’ expectations on all sides.

5. Herd the cats. To make sure deadlines are met, take charge and keep everyone and everything on course. Setting the deadlines thoughtfully and aggressively is important, but it is pointless unless you are hyper-involved (remember step two) and herd the cats. Each turn of the documents has to be sent with a goal and deadline, and a specific deadline, not “later this week”. Be direct with others about what is needed and follow up to keep on pace. Remember, time is your enemy. If the documents stall, typically defined as taking more than three days to be returned, organize what’s called an All Hands Call where the investor, both sets of lawyers and you talk about the hold up.

6. Set the close date. As documents look like they are close to finished, decide when the money will be wired and all final docs signed. Closing often takes place a day to seven days after the documents are completed. Talk to investors multiple times during these final days to confirm everyone has lined up their wire transfers and they are ready to sign the documents. Once again, stay hyper-involved.

Now you’ve closed. Congratulations. While the tactical steps are over, now is a great opportunity to show your excitement for your new partners (the investors). Be authentic and send an individual note to each investor. Explain why you are thrilled to be their partner, making the note genuine and personal, not generic. These investors took a chance with you and gave you their money because they believe in you. Don’t go dark during the last stages of fundraising, or after the money is in the bank.

Raising capital is one of the most stressful parts of being an entrepreneur, but it’s also critical. Follow these steps and you can ensure the closing is not only efficient but you’ll shine as a leader to your investors.

/Hero%20Backgrounds/Gradient-Sun-med.jpg?width=300&name=Gradient-Sun-med.jpg)