By: Lucas Huizar

By: Lucas Huizar

Not everyone knows it yet, but the world of startups and investing changed radically last year. That is when the JOBS Act of 2012 lifted a ban on communication that kept startup financing behind closed doors for over eighty years.

1933 – 2013: The Two-Tier System

The JOBS Act is one of the largest changes in U.S. securities laws since the 1930s, when these laws were first framed.

Public Offerings

The year: 1933. People had limited access to information and could be defrauded by a telephone voice and some fancy letterhead promising a great investment. Those defrauded had little, if any, recourse.

The Securities Exchange Commission (“SEC”) responded by passing the Securities Act of 1933 to provide additional protections to investors. The Securities Act requires that all investments made available to the general public must go through an involved registration and compliance process (“going public”), which includes publishing an SEC-approved prospectus and maintaining regular, audited financial reports.

Enforcing this transparency and verification protects investors, but it also makes SEC registration enormously expensive for companies. Consequently, it is easiest for big companies and fixed income issuers to shoulder the costs. These investments constitute the public markets, the major stock and bond exchanges.

Private Offerings

But the Securities Act also created a second tier of investing above the public markets, by defining registration exemptions that let investment offerings bypass the full registration process. One important requirement for these exemptions, however, is that the offerings and deals must take place in private, to avoid a cacophony of advertisements. Historically, public advertisement has been strictly prohibited.

Another notable requirement is that investors must be accredited, which in the case of individuals means investors who meet the “accreditation” threshold—generally earnings of more than $200,000 a year or a net worth greater than $1,000,000, not including equity in the investor’s primary residence. Currently about 2% of the adult population meets this threshold. The rationale behind these restrictions is that accredited investors are better able to judge investments and better able to bear any financial loss.

This is the world of private equity. The private equity market, which constituted upwards of $3.7 trillion in assets under management last year, is where early investing in successful startups happens. This is where new ideas take root as companies stay private longer—making exposure to these markets for the discerning investor increasingly important. Without it, investors are missing out on our nation’s fastest growing companies—our innovation economy.

Private Offerings Going Public: The Evolution of Rule 506

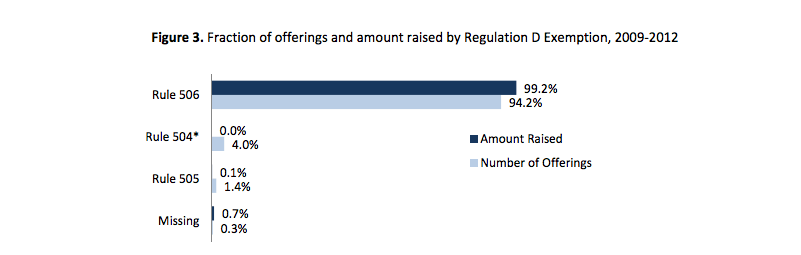

In the law itself, the most popular registration exemptions for private equity are defined under Regulation D of the Securities Act (“Reg D”), in particular its Rule 506, which historically accounted for about 99% of Reg D private equity deals by dollars raised, and 94% by volume.

Historically, Rule 506 allowed investment offerors to raise unlimited amounts of capital from unlimited numbers of accredited investors, and it also permitted investment by up to 35 unaccredited investors with whom the offeror has a “substantial pre-existing relationship.”

Enter the JOBS Act of 2012, an omnibus bill of far-reaching financial reforms that passed the House individually the previous year and were then bundled together. Title II of the JOBS Act, “Access to Capital for Job Creators,” upended 80 years of regulatory precedent by creating a new Rule 506-based exemption, 506(c), which allows entrepreneurs to solicit investments publicly. (Investors must still be accredited.) This new exemption, Rule 506(c), was made available to entrepreneurs on September 23, 2013.

For entrepreneurs seeking capital, this basic rule change means they can put their pitch deck and make their investment case online, rather than (or in addition to) traveling around repeating their story to investors in different cities behind closed doors. It also means that they can demo their prototype or discuss their business plan at open conferences, other public events, or even live television without necessarily running afoul of SEC regulations.

For investors, the 506(c) exemption opens up worlds of potential investments on the open web, where they were previously restricted to just the ones they learned about through closed online communities or via word-of-mouth.

With 506(c), the world of private equity is, well, no longer so private. We believe this is a great thing—making private equity markets more accessible and efficient for companies and investors alike. Transparency, and increased opportunity for both sides of the market, can help individual investors find better returns, and reduce the time it takes for worthy companies to raise the growth capital they need to thrive.

Have questions about 506(b) or 506(c)? Would love to be helpful — let me know in the discussion below. (Of course, always best to consult counsel for specific legal advice.)

ABOUT THE AUTHOR:

Lucas joins CircleUp from Electronic Arts Inc. where he was Senior eCommerce Counsel and Lead Counsel for the Pogo Label. As Senior eCommerce Counsel, Lucas directed eCommerce policy, provided counseling regarding direct-to-consumer initiatives, and led a global eCommerce legal group to support online business initiatives. Before joining Electronic Arts Inc., Lucas was a patent and complex commercial litigation attorney at Farella Braun + Martel, LLP. Lucas received his JD from Stanford Law School and a BS in Genetics from the University of California, Davis.

,%20Private%20Offerings%20Go%20Public/The%20Evolution%20of%20Private%20Equity%20Markets%20With%20506(c)%2c%20Private%20Offerings%20Go%20Public.jpeg?width=300&name=The%20Evolution%20of%20Private%20Equity%20Markets%20With%20506(c)%2c%20Private%20Offerings%20Go%20Public.jpeg)