By: CircleUp

It’s the same old story: operations and finance guy moves to California; gets entrepreneurial bug; and leaves corporate job to work on startups. Except Grant Burton didn’t quit his job the moment he landed in California. Instead, he says, it took years to convince him to make the leap from a steady job at a large corporation to smaller gigs with riskier startups, though eventually, he did take the leap. “I wanted to be more involved in the success of a company,” he says. “So I spent a lot of time building the fundamentals, getting involved in fundraising and gaining firsthand experience in operations.”

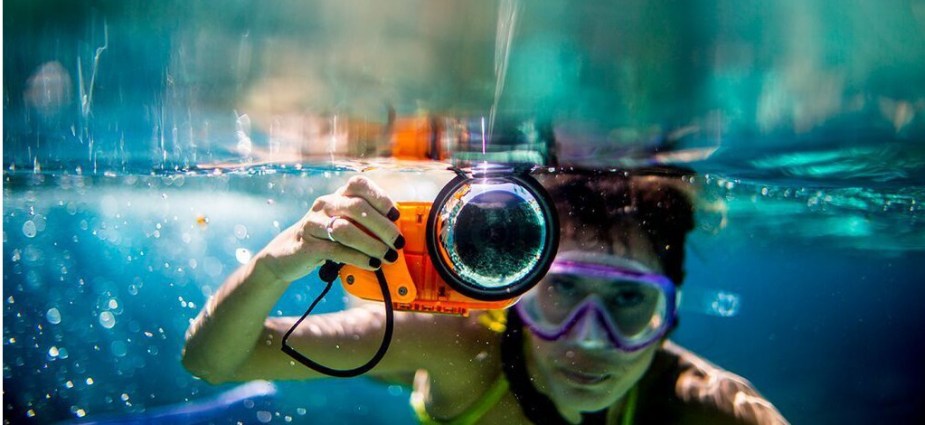

These days Burton’s focus is as the CFO for Watershot, a company that makes waterproof cases for smartphone photography. And while the Watershot product line itself is worthy of an entire interview — they’re outfitted with lens ports and you can actually dive with them, just for starters — we wanted to focus on Burton’s experience and expertise in fundraising. While waiting at the mechanic for an oil change, Grant was kind enough to give us a call and impart a little of wisdom on how fundraising has changed over time.

Let’s start with a bit about your background.

Sure, so I’m originally from Europe, but I’ve been in San Diego for many years. I was at Price Waterhouse Coopers in Canada, Europe, and the US. I left the company 11 years ago and joined Cricket Wireless, then joined a company that was innovated and created the wireless device trade-in business. To keep phones out of the landfill. So I know quite a bit about mobile devices.

And what made you want to join the Watershot team?

I’ve known the founder, Steve Ogles of years. The idea behind Watershot was to build a dive housing for iPhone that lets you take it to official dive depths: 60 meters and still use the video and camera functions. Then a year ago we decided to build a broader, more consumer-oriented product. The company’s focus has been bulletproof underwater protection and imaging for the iPhone. And we chose the iPhone because the best camera today is the one you have in your pocket. Apple is putting a tremendous amount of focus on imaging and that means you have the ability to take incredible pictures with your phone and then share them instantly from the same device, without getting out of the water.

What have you seen as far as changing trends in fundraising?

What I’ve found that’s happening quite quickly is there’s an increasing number of investors and investment sources. On the other hand what I’m finding is that early stage investors have a decreasing appetite for risk. So there are more sources, but many of them are reluctant to invest if it’s early or you don’t have much revenue. They’ll wait until you gain more traction or acceptance in the marketplace before they’re willing to commit capital. I remember fifteen years ago, venture capitalists were making investments in people, in technology that were truly risk-based— meaning no revenue, no customers.

But they had ideas and they had the talent and the passion to move those ideas forward. Now I’m finding that the quality of the team, the ideas, the technology aren’t enough for a lot of folks anymore, without traction in the marketplace. And that presents the challenge of how do you bootstrap to that point where you can then attract the serious capital?

And what are some of the biggest challenges you experienced regarding fundraising?

You know, I think it was initially finding consumer-products oriented investors and luckily we got referred to CircleUp as an avenue for that. One other challenge has just been finding investors who were willing to write smaller checks, because we didn’t need $5 or 10 million.

What have you found to be the most effective way to keep investors informed?

I was involved with a company that had raised money with a larger than normal number of investors and we found it effective to, on a quarterly basis, put together a summary information and hold a conference call. That was generally well received and appreciated.