Three years ago, it seemed that early stage consumer packaged goods (CPG) brands had only one viable exit opportunity – a sale to a strategic acquirer. Today, several new options have emerged, including aggregators and public markets. We get a lot of questions from entrepreneurs about the different exit opportunities available, and wanted to take this opportunity to post some details and resources, both positives and negatives of each below.

Public Markets

There have been several CPG brands who have opted for an Initial Public Offering (IPO) in the past year, including high-profile brands like Hims&Hers, Oatly, and the Honest Company. While increasing your profile, there are also some considerations to the public market route.

Positives of public markets:

- Boost awareness for the brand

- Provide liquidity for early investors and employees

- Provide a more liquid asset to attract new management talent

- Size of capital raise if often more difficult in private markets

Negatives of public markets:

- Public companies must incur meaningful costs to ensure they are meeting the financial disclosure requirements of the Security Exchange Act of 1934, as well as regulatory requirements of the Sarbanes-Oxley Act. This includes the cost of ongoing financial reporting, audit fees, board committees and investor relations departments. This can add up to over $750K to go public and can take up to 18 months.

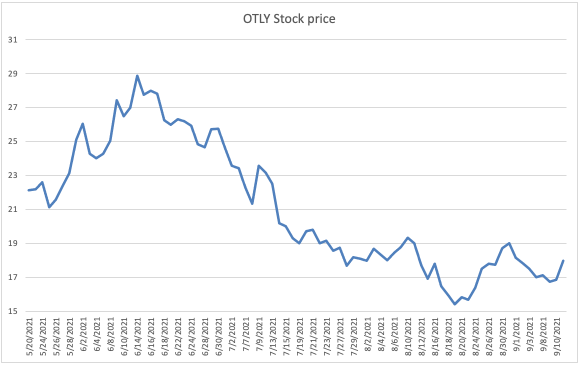

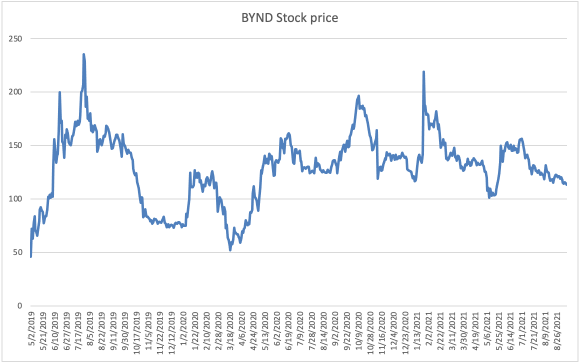

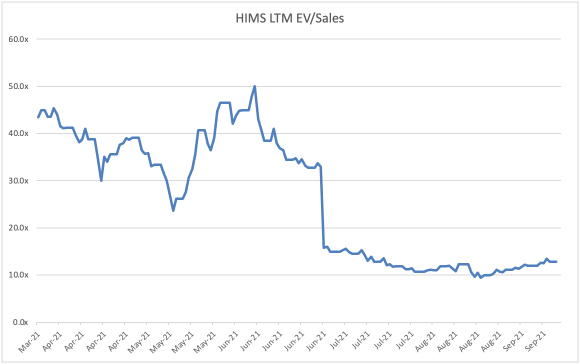

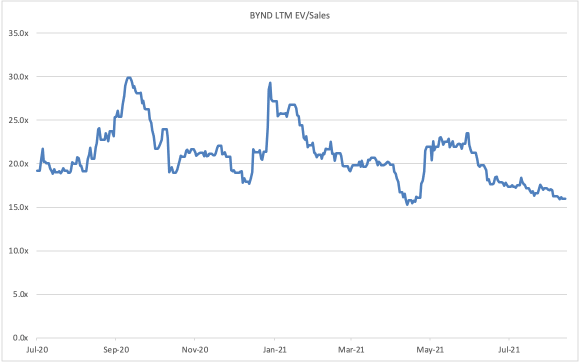

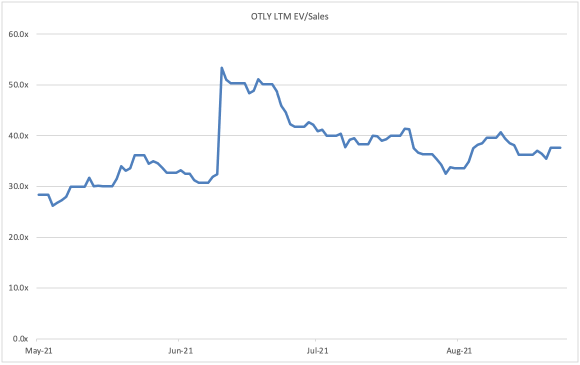

- Public market pressures. The financial markets can be very short term focused and stocks, especially smaller market cap stocks, can be subject to huge swings in their share price. Oatly (OTLY), which went public in June of this year, went public at a price of $22.50, jumped as high as $28.50 and now sits at $16.50. That is a $6B swing in market cap, or 40% swing peak to trough in under four months. Beyond Meat (BYND) has seen eight 20% swing price swings in the past 12 months and four 35% price swings. That sort of volatility is not for the faint of heart, for management who often have significant compensation tied up in stock, or for investors.

Recent stock price performance:

Source: Sentieo

Small cap no-man’s land. For the most part, large institutional investors need a certain level of trading volume to actively invest in a stock. They are looking for liquid investments so they can build a position without moving the stock in a material way, but also so they can exit easily if things go wrong. When a company doesn’t raise enough money during its IPO and doesn’t have large enough trading volume, it can get caught in small cap no-man’s land. Below normal trading volume will cause institutional investors to sell at the IPO, which will drive the stock price down, which will drive the dollars traded down, which will cause additional institutional investors to sell……..you get the picture.

Is there a public / private market arbitrage?

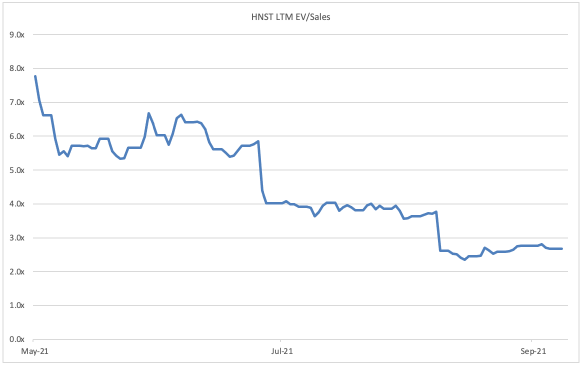

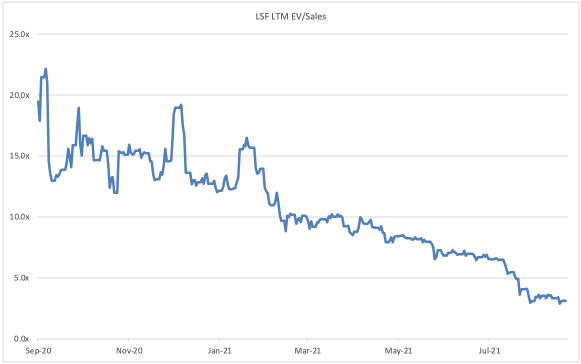

It is unclear if valuation is a pro or a con for the public markets. We often hear about the public / private market valuation arbitrage, implying that a company will trade for a higher valuation if it is a publicly traded stock compared to what the private market will be willing to value the company. Unfortunately, there tends to be some cherry picking when looking at this. As you can see below, there are several public market brands that trade at higher multiples than their private market peers (3-6x EV/revenue, according to CircleUp’s proprietary database). Oatly and Beyond Meat are two great examples of that. However, there are also examples like Honest Co or Laird Superfood which started trading at a premium, but now trade at a discount to many deals we see in the private markets.

Given the public markets are fluid and stocks get revalued every day, the disconnect between private market and public market valuations can flip quite quickly. So don’t expect going public to guarantee a higher multiple vs the private markets.

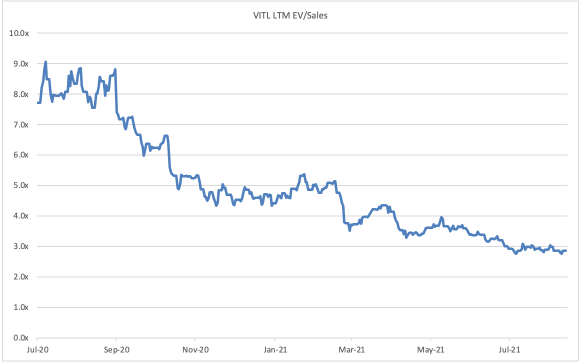

LTM EV/Sales

Source: Sentieo

Aggregator – lots of capital available, but moderate valuation expectations.

In the past year, the market of Amazon Aggregators saw rapid growth. The parent company will acquire brands sold on Amazon and other online venues, will offer up shared resources like marketing, SEO and logistics and will help the business scale.

What they are looking for:

- Sales & Profits – most require a minimum of $1m in trailing twelve months revenue and are looking for profitable businesses with 10-15%+ EBITDA margins.

- Brands – own branded products vs private label

- % from Amazon – it varies by aggregator, ranging from 30-75%. Most require Fulfilled by Amazon (FBA) as well.

- Product market fit – while the market doesn’t have to be huge, the aggregators are looking for products which have shown customer loyalty and brands that aren’t viewed as short term fads.

Pros of partnering with an aggregator:

- Aggregators can help founders who are great at product development, but need help on SEO, marketing and logistics. They also can help brands reach growth potential, including international markets, likely faster than they could on their own.

Cons of partnering with an aggregator:

- Valuations often based on profits vs growth. Deals are almost always full acquisitions, so the founder will have to negotiate a way to participate in the upside if desired.

Some of the larger players include:

| Thrasio | Min of $1m in TTM revenue; focused on large markets, looking for primarily Amazon businesses |

| Branded | $1m in TTM revenue; focused on FBA brands; categories include health & beauty, kitchen and dining, arts & crafts, sports, pet, baby |

| Benitago | $1m in TTM EBITDA; open to non-consumable categories including technology and home. Targeting 5 acquisitions / month (!!) |

| Foundry | Open on size (will go dub $1m in TTM) and more open to non-Amazon businesses. |

| Accel Club | Looking for brands between $600k – $25m of TTM revenue; product categories include baby, beauty & personal care, health, home consumables, sports, pet. Will revalue based on NT performance |

| Greenhaus | One of the few who target brick & mortar as well as Amazon / DTC brands. Looking to do 2-4 brands / year. Priority categories include health, beauty and personal care, pet, household consumables. $750k-$10m in TTM revenue |

Strategic Acquirer – the original option, but bar being raised:

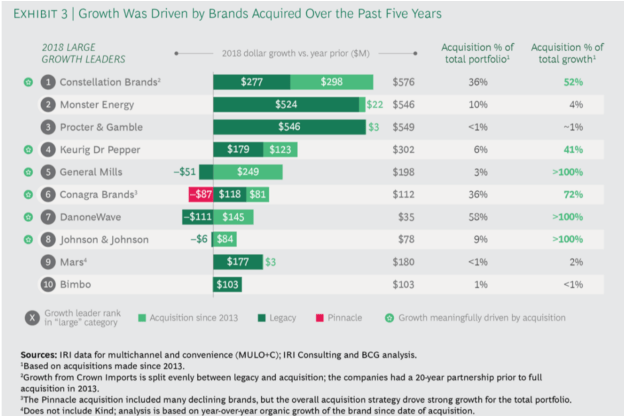

Growth in the CPG space continues to be dominated by smaller, innovative brands and this continued during COVID and during economic slowdowns as my colleagues Madeline Darcy and Audrey Gibson discuss here and here. Acquisitions are key to the growth of these brands, as you can see in the BCG study published below.

Source: BCG

Anecdotally, we have heard that strategics in the food space are looking to make larger acquisitions that have proven consumer fit. Brands that are north of $50m in revenue that they can envision being a $500m brand in relatively short order. Whereas beverage brands, alcohol brands in particular, are looking to tie up emerging brands early, whether that be with direct investments or other strategic partnerships.

Regardless, a founder should be looking to give up control of its brand with a strategic acquisition. This can be emotionally hard, but usually inevitable. The founder is often expected to stay on for a year or more to help with the transition, lead the team and potentially work as a longer term consultant for the larger brand.

Conclusion

While there are now several more exit options for founders, there is no clear winner in terms of what is best for the founder or the brand. The devil is in the details and it is always recommended to have a group of experienced advisors and/or board members to help you through this decision.