Supply chain issues: the topic seems to be making headlines almost daily, and you likely have experienced them in one shape or another, as either an operator or a consumer, in the past year. But what are they actually, how long will they continue, and what are the potential risks for consumer goods businesses?

Where’s my inventory?

Since the creation of online shopping, people have been buying stuff from the comfort of their own home. That practice was catapulted in 2020 when the world closed down due to COVID-19 and our only safe option was to buy products through eCommerce retailers. But skyrocketing demand and limited supply around the world led to unprecedented delays. Nothing makes time go slower than tracking your shipment, and wondering why it’s six weeks late. By now, we have all experienced a delay in a purchase being shipped due to supply shortages across the globe and the operational nightmare that is international shipping. How does this impact the consumer packaged goods (CPG) industry, especially as we head into the holiday season? Is this all because of the Ever Given (remember that)?

Source: BBC News. An excavator attempting to dig out the Ever Given from the Suez Canal in March 2021.

What is causing the supply chain issues?

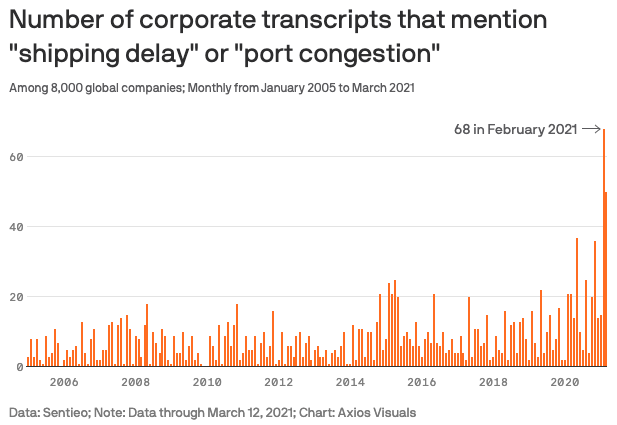

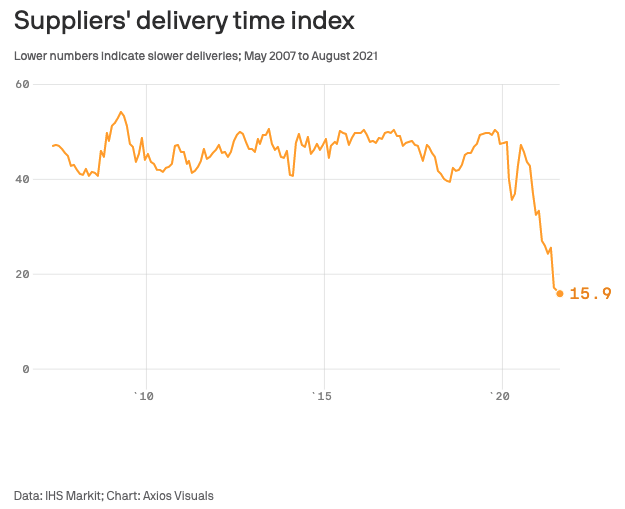

Companies are shipping more than ever before in response to post-COVID trends in online shopping. Amazon alone has seen record profits for four straight quarters and has been on a hiring spree to keep up with new demand. The shipping industry was not ready for this shift in consumer behavior—from neither a processing nor a technology standpoint. Import volumes have surged in the United States, while exports from the country are down, meaning there are fewer empty containers for those imports to come to America. The industry has had to adjust accordingly and is now sending ships back to China with empty containers just so it can have enough to fill back up. According to Bloomberg, shipping companies are “rolling” 37% of containers, versus the pre-pandemic average of 8%.

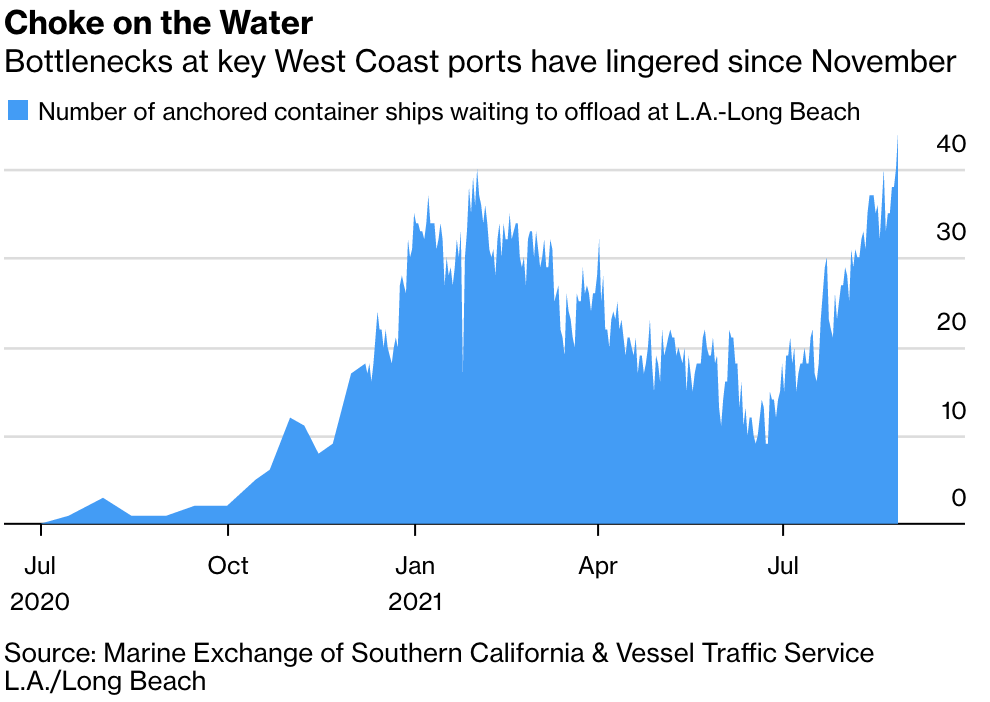

Once a container is able to actually make it across the ocean and to the United States, the situation does not get much better. The Los Angeles and Long Beach ports, which account for approximately one-third of US imports, are experiencing severe delays due to labor shortages, COVID-19 disruptions, and holiday buying surges. Kip Louttit, executive director of the Marine Exchange of Southern California, stated, “Part of the problem is that ships are double or triple the size of the ships we were seeing 10 or 15 years ago. They take longer to unload. You need more trucks, more trains, more warehouses to put the cargo.” The CEO of Dollar Tree said on a recent earnings call that, “a real-life example of the kinds of challenges we’re seeing, one of our dedicated charters was recently denied entry into China because a crew member tested positive for COVID, forcing the vessel to return to Indonesia and change the entire crew before continuing. Overall, the voyage was delayed by two months. With the current pressure on carriers, once disruptions in the supply chain occur, there is not enough capacity to make it up.”

How long are supply chain delays going to be an issue?

Many experts predict that supply chain issues will continue to be a problem through 2022, which would continue to delay the shipping of your favorite products. For example, Mario Cardero, executive director of the Port of Long Beach, California, told The Wall Street Journal that he doesn’t “see substantial mitigation with regard to the congestion that the major container ports are experiencing.”

How do supply chain issues impact the consumer goods sector?

Donny Rouse, chief executive of Rouses Markets, said in a recent Wall Street Journal article that “he is struggling to fill shelves as his company runs low on everything from pet food to canned goods. The chain of more than 60 supermarkets is sometimes receiving as little as 40% of what it orders, prompting Mr. Rouse and his staff to try to secure products earlier and more often.” Stores are also starting to rethink how they order products. This includes ordering fewer flavors and sizes, ordering from different brands, or creating their own private labels to fill the shelves. For example, Rouses launched their own private label Lunchable alternative because they couldn’t get orders from Kraft Heinz. Walmart has reinstated penalty fees for late or incomplete orders.

How can CircleUp help address your supply chain needs?

CircleUp understands the challenges that companies are currently facing and are eager to help during these challenging times. We’re offering two solutions to brands:

- Join our Inner Circle Community where more than 400 entrepreneurs share stories and resources, or you can connect with someone to talk to about the challenges you are both facing!

- CircleUp Credit Advisors offers working capital lines backed by Accounts Receivable, Inventory, and Purchase Orders. Establishing a line of credit at this time can be beneficial as you might be investing more in inventory at this time to make sure you have the product you need to meet demand. While this inventory is at your warehouse, CircleUp can advance upon these goods to provide you with additional working capital so your cash is not tied up in the assets already produced. CircleUp can also provide you working capital for purchase orders you might be getting and you need additional capital to build out the necessary inventory. This is a great option for a borrower that is rapidly growing into new stores and needs help producing more inventory to keep up with demand! Get started today.