By: Sara Hillstrom

By: Sara Hillstrom

Investments in small, innovative food companies can be quite lucrative. These firms have attracted the attention of larger Consumer Packaged Goods (CPG) organizations that are on a quest for innovation, and paying substantial multiples to get it.

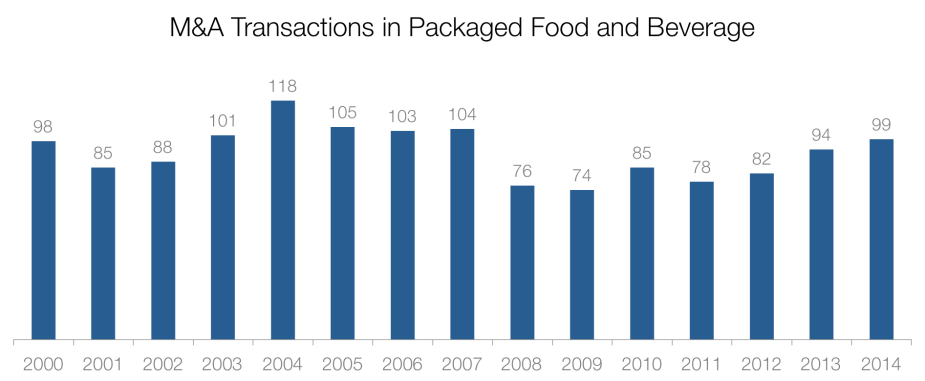

Packaged food and beverage is a steady, countercyclical, low single-digit growth, $368B[1] industry. It is also an industry with consistent M&A activity. While large, incumbent CPG firms depend on innovation to drive growth, they have failed, for a variety of reasons, to develop breakthrough new products. To overcome such difficulties, these firms routinely obtain innovation through M&A.

The importance of innovation (and revenue growth), combined with the substantial supply chain synergies that result from these mergers, have pushed purchase multiples in some transactions to ~20x EBITDA[2], making investments in small companies within this industry quite attractive.

In order to capitalize on this opportunity, an investor must identify which companies have the potential to become an acquisition target.

This starts with finding a great product: something delicious, memorable and wrapped in a sexy package. Many such products exist on the market today, so, it is also important to find unique products that will be exciting to a retail buyer. While there is no silver bullet, there are a few guidelines that can steer you in the right direction.

Consider Healthy and Better-for-You Products

It’s no secret that consumers are looking for healthier options. However, there is a lot of noise in the industry about what this looks like. Should we all be investing in non-GMO products? Looking for the next superfood? Maybe it’s all about food replacement solutions?

Not quite.

The truth is that people still want to indulge. They just want better choices when they do it. Consumers are looking for more nutritional value from the products they eat, without compromising on taste of course. One great example can be found in the salty snack category.

Despite being known for high sodium content, high fat, and a general source of empty calories, chip sales topped $12B in 2014 [3]. In 2006 an innovative entrepreneur decided to change what this category was all about, and launched Food Should Taste Good (FSTG). These chips are not only cholesterol-free, trans fat-free, and gluten-free, they are also made with unique ingredients such as sweet potatoes and pinto beans. General Mills recognized the power of this brand and acquired FSTG in 2012.

Skinny Cow is another example of a brand that helps consumers make better-for-you choices. This low-fat and low-carb ice cream sandwich was not the first diet ice cream to hit the market, but may have been the first one that still tasted like ice cream. By giving consumers a healthier and delicious option for dessert, Skinny Cow quickly grew. It’s no wonder Nestle snapped them up in 2004 for $65M.

Consider Promising Companies With Natural/Organic Products

Natural and organic has long been a sought-after category and represents a growing portion of M&A activity. In the past 5 years many large CPGs have completed an acquisition of a natural or organic company, including Nestle and Sweet Leaf Tea (2010), Campbell’s and Bolthouse Farms (2012) and General Mills and Annie’s (2015).

Big CPGs pay top dollar for these companies because they have a difficult time launching natural/organic products under their existing brands. Consumers have a hard time believing the same company that makes an unhealthy/indulgent product is also a leader in health-focused all-natural products. To get around this, some large CPGs sell their natural/organics under another brand, as General Mills does with Small Planet Foods, a brand it acquired in 1999.

These trends are likely to continue and natural/organic will be an even greater acquisition target in the future.

Watch Out for Investments in Commodities

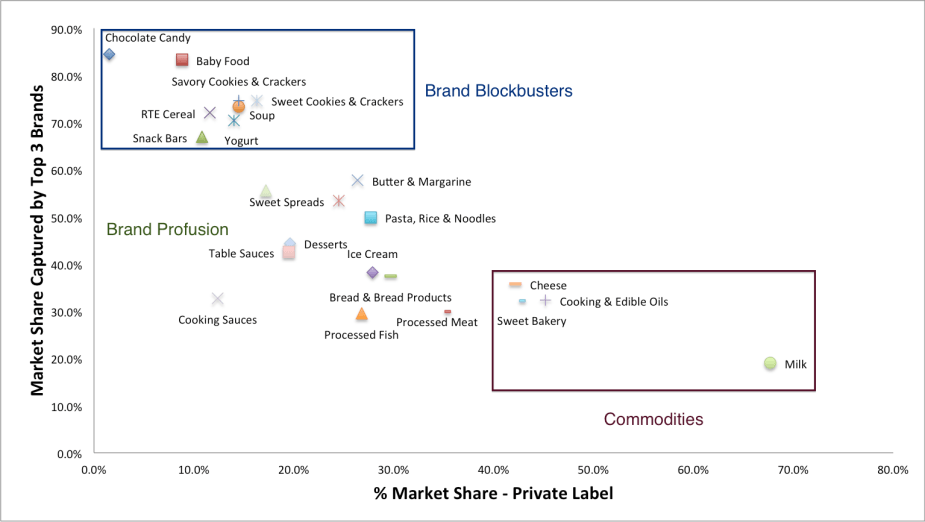

The least desirable place to invest is in products that are highly commoditized. Consumers in these categories are price-driven, rather than brand-loyal. This puts intense pressure on margins and strips away many competitive advantages an upstart food company might have.

What signals can investors look for that indicate a category is commoditized?

A good indicator is the prevalence of private label. The highest private-label-driven categories are cheese, cooking and edible oils, shelf stable processed fish and milk. While acquisitions do occur in these categories, they are led by food companies that already operate within this space. Instead of acquiring smaller brands to unlock entrance into new categories, companies driving M&A in these high private label categories are typically looking to go from a regional to a national strategy. These types of acquisitions tend to yield lower multiples, 10 – 12x EBITDA, and should be approached with caution by investors.

Great Products, However, Do Not Look the Same Across the Grocery Store

Each category is at a different stage of development and faces different competitive forces. What it takes to compete successfully in one aisle may not work in another. Innovation, therefore, looks different in each category and investors should evaluate prospective targets with this in mind.

The chart below maps the category dynamics in terms of private label presence (horizontal axis) and brand consolidation (vertical axis). Categories on the right are those in which private label has captured substantial market share.

The categories on the left are brand-focused categories and represent a more attractive opportunity for investors. These categories can be broken down into two groups: Brand Profusion and Brand Blockbuster.

Brand Profusion Categories Are Relatively Fragmented, With the Top Three Brands Controlling Less Than 60% Market Share

This competitive landscape gives small brands more flexibility when they enter the market. With less dominant incumbent brands, new products can win shelf space from smaller players long before going head-to-head with a CPG giant and it’s huge marketing budget. Let’s explore why by looking at the desserts category.

Within desserts the top 5 brands make up about half of the category, and no one brand holds more than 20% market share. If a small company launched a new dessert product it could target Father’s Table, C&F, Hillshire or the even smaller brands lumped together in “other” when looking for it’s initial shelf space. The presence of smaller players leaves room for new entrants to gain traction without attracting the attention, and competitive reaction, of the CPG giants.

Within these categories it is very important to find products that fit consumer trends. Small brands lack resources for traditional branding-building and advertising activities and thus must find ways to catch the consumer’s attention in the aisle.

The best way to attract a consumer’s attention in a Brand Profusion category is with products that are aligned with foodie consumer trends.

Since much of a new products’ brand awareness comes organically from the consumers themselves, it is important to launch products that fit into consumer desires.

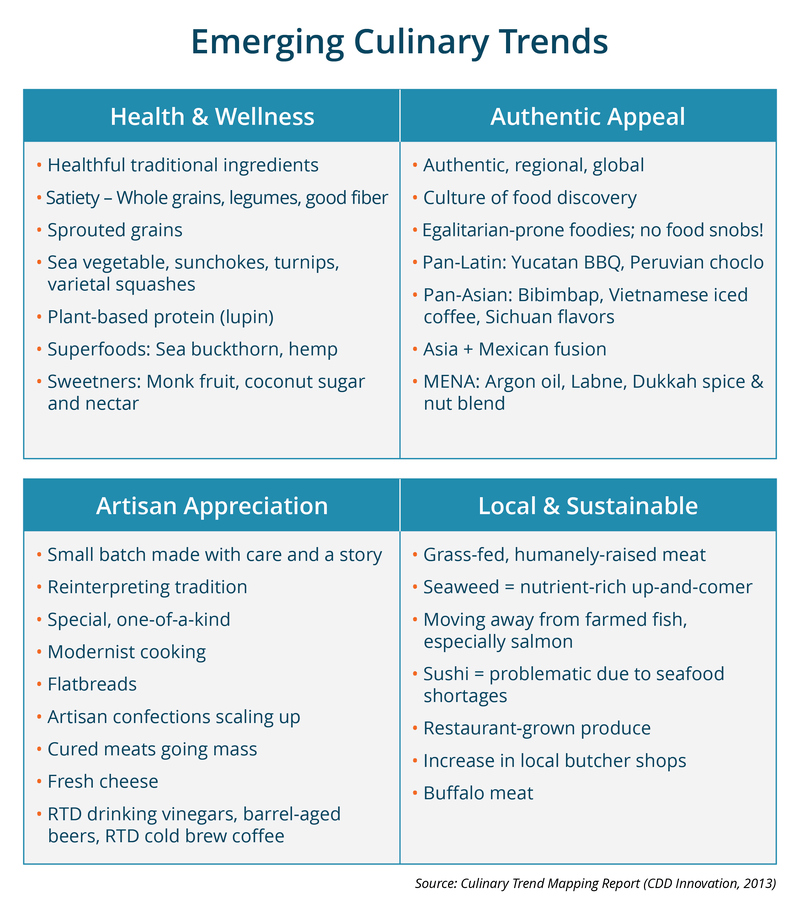

The key trends to look for fall into four buckets:

- Health & Wellness

- Authentic Appeal

- Artisan Appreciation

- Local & Sustainable

When a product hits at least two of these trends, customers will be more likely to take notice and small brands will be more likely to succeed. This has certainly been true for SeaSnax, a cracker-like snack made of seaweed.

SeaSnax is a very healthy product that is low in fat, low in calories and rich in minerals and nutrients. It also has authentic appeal as a popular snack in Korea. The company enhances this appeal by offering Asian + Mexican fusion flavors such as chipotle wasabi. Finally, SeaSnax proudly claims to use sustainably-grown seaweed, which also happens to be a hot ingredient that is expected to be more popular in a wide variety of products launching in the coming year.

These factors likely played a role in driving the 988% growth SeaSnax saw last year and secured its place as the 479th fastest growing private company in America for 2014. [4] They also made SeaSnax a salient example of what an investor should look for in a potential target.

Brand Blockbuster Categories Are Those in Which the Top Two or Three Brands Dominate the Market

In Brand Profusion categories there are a large number of brands competing against each other. Brand Blockbuster categories, on the other hand, have two or three brands that control most of the market share. These categories are often defined by intense rivalries between two powerhouses. Kellogg’s and General Mills. Campbell’s and Progresso. Hershey’s and Mars.

In many ways these categories are ripe for disruption. When incumbent brands secure the majority of the market share they often all play by the same, well-established rules and thus become complacent. Small, nimble, entrepreneurial companies are poised to approach the category differently, unlock innovation and upset these CPG giants. Deyrck van Rensburg, a President at Coca-Cola Company, estimates that “as much as one-third of the industry’s growth in North America over the next five to ten years could come from disruptive brands”. [5]

However, finding success as a new, small brand in these categories is not easy. These CPG giants have massive marketing budgets and tremendous resources that they will use to defend their position. Entrants will have a hard time competing with large brands on price, new flavors or slightly more exciting packaging. Instead, new products will need to drive excitement with retailers and consumers alike. This cannot be done with only marginally-better products. New products can only succeed in Brand Blockbuster categories if they are truly unique.

Investors Evaluating Innovation in Brand Blockbuster Categories Should Look for Products That Change the Way People Are Eating, Create a New Eating Occasion, or Are Markedly Different From Existing Products

An example of one such innovation is the baby food pouch. In 2006 Ella’s Kitchen launched a brightly colored baby food unlike anything on shelf. Ella’s brought a much desired organic line, unique flavors, and most importantly, a convenient package that allowed older babies to feed themselves (i.e. changed the way the consumer was eating). Ella’s attracted the attention of busy moms and began flying off the shelf. Ella’s success even enticed two other companies into the category – Happy Baby and Plum Organics – who also gained strong momentum.

Antitrust laws likely would have prohibited Nestlé (Gerber) from purchasing these companies. However, the pouch brands proved to be lucrative acquisition targets for other CPGs. Hain Celestial purchased Ella’s Kitchen to add to its Earth’s Best baby food portfolio. Danone acquired Happy Baby in what some speculate was an opportunity to expand the Dannon brand into new aisles. Campbell’s acquired Plum in an attempt to diversify its portfolio and reach a different demographic. While the specifics of these deals have been kept private, they serve as salient examples of how new innovation can be an attractive acquisition target for a wide variety of CPG firms.

While there are number of other factors that will influence an upstart food company’s chance of success, the above points provide investors with a general guide to the food landscape. Better-for-you, natural and organic products will continue to represent an exciting opportunity for investors.

Investors also need understand the category dynamics when evaluating an investment target. Brand Blockbuster categories require strong innovation that changes the way people are eating in order to win against the large CPG giants. Brand Profusion categories allow more flexibility for new brands because there are more companies to target when gaining distribution. However, products need to deliver what consumers want – health and wellness, authentic appeal, artisan appreciation and local and sustainable. Those who are able to find the right opportunities today will be the beneficiaries of their success tomorrow.

Sources

- Euromonitor. (2014). Market Sizes (Packaged Goods). Euromonitor.

- Thompson ONE. (2014). M&A Deal League Table. Thompson ONE.

- Kraushaar, A. (2015). Chips, Salsa and Dips – US – January 2015. Mintel Market Reports.

- INC. (2014). Top Food & Beverage Companies on the 2014 Inc. 5000.

- Moye, J. (2013, March 6). The Next Big Thing: How Coke’s Venturing & Emerging Brands Team Stays a Step Ahead of Tomorrow’s Thirsts.

ABOUT THE AUTHOR:

Sara Hillstrom is a second year student at Harvard Business School. Prior to getting her MBA, Sara spent 7 years in corporate finance in CPG working for General Mills and Nestle. For the past two years Sara has analyzed the M&A activity across the industry and become an expert in key innovation trends in food and beverage.